❖ Finance Minister Nirmala Sitharaman presented her seventh straight Budget on July 23 for the fiscal 2024-25.

❖ She surpassed the record of former Prime Minister Morarji Desai.

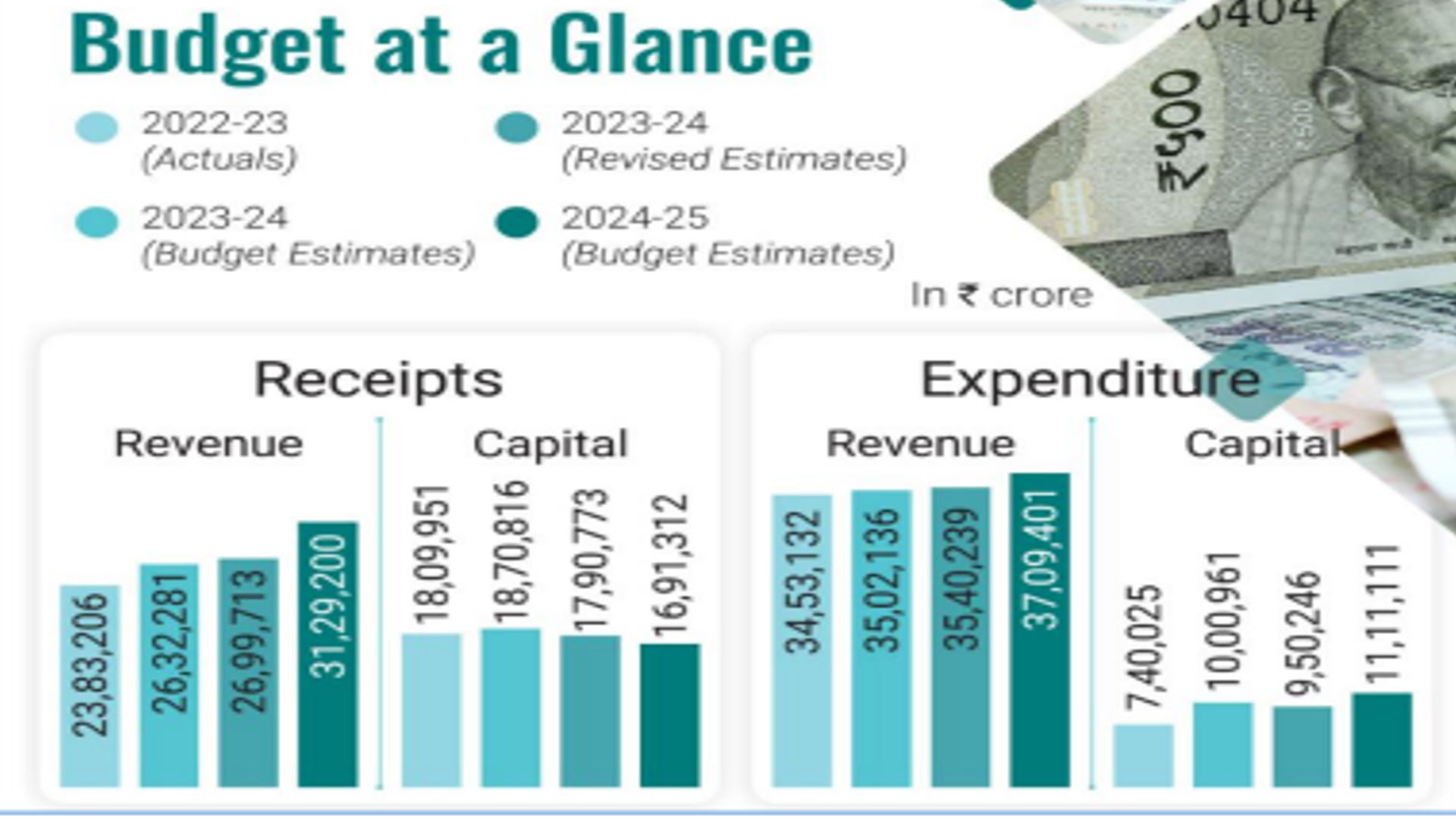

❖ The total receipts other than borrowings and the total expenditure are estimated at Rs 32.07 lakh crore and Rs 48.21 lakh crore respectively.

❖ The net tax receipts are estimated at Rs 25.83 lakh crore and the fiscal deficit is estimated at 4.9% of GDP.

❖ Also, the government will aim to reach a deficit below 4.5% next year.

❖ The gross and net market borrowings through dated securities during 2024-25 are estimated at Rs 14.01 lakh crore and Rs 11.63 lakh crore respectively.

❖ She announced three new employee-linked incentive schemes in the Union Budget.

❖ Students who have not yet benefited from any government schemes will get support loans of up to ₹10 lakh for education in domestic institutions.

❖ The standard deduction for salaried employees will be hiked to ₹75,000, from ₹50,000 under the new income tax regime in FY25.

❖ This Budget proposed a reduction in the basic customs duty on gold and silver to 6 per cent and platinum to 6.4 per cent.

❖ The finance minister announced several schemes for Bihar in her speech. The schemes are a part of a larger plan titled “Purvodaya”.

❖ It covers the all-round development of eastern States including Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

❖ The government will support building of expressways in Bihar at a total cost of ₹26,000 crore.

❖ For promoting women-led development, the budget carries an allocation of over ₹3 lakh crore for schemes benefitting women and girls.

❖ The rate of taxation remains unchanged, the size of each of the slabs, excluding the initial zero to ₹3 lakh, remains unchanged.

❖ The erstwhile slab of ₹3 lakh to ₹6 lakh would now be expanded to ₹3 lakh to ₹7 lakh.

❖ However, the rate of taxation, that is 5%, remains unchanged.

❖ Similarly, the other slabs, that is, ₹6 to 9 lakhs, ₹9 to 12 lakhs, ₹12-15 lakhs and thereby beyond, would be revised to ₹7-10 lakhs, ₹10-12 lakhs, ₹12-15 lakhs and thereby beyond.